Last week’s biggest crypto news with a special bonus deal inside.

Crypto News: Top Stories Last Week Revealed

June 12, 2023

Crypto News: Top Stories Last Week Revealed

June 12, 2023

Last Week’s Biggest Crypto News

Last week in the crypto world we saw the 2011 MtGox hackers identified, the Metaverse vs Augmented Reality battle heat up, and Coinbase and Binance face the wrath of the SEC.

Don’t miss out on 50 BONUS SPINS on the ferocious Wolf Wild today. Claim the code WOLF50 with a deposit of $3o or more and land your own big win on Wolf Wild today – FIRST 50 PLAYERS only so get yours now!

Metaverse vs AR Battle Heats Up With Apple’s Vision Pro Headset

The launch of Apple’s Vision Pro headset last week took the metaverse vs Augmented Reality (AR) battle into a new (and much more expensive) dimension last week and represented the first gauntlet being thrown down in favor of AR.

The company has previously distanced itself from the generally accepted concept of a metaverse in favor of a combined virtual and augmented reality offering, a vision which puts it in direct competition with Meta, which is banking everything on building its vision of the metaverse.

Apple CEO Tim Cook laid the groundwork for the concept for the Vision Pro last October when he questioned whether the metavserse had the capabilities to dominate AR in the long term. Cook opined that AR is going to have the same impact on people’s lives as the Internet and smartphones, saying that one day it will be impossible to live without it, and the Vision Pro represents the first physical manifestation of this vision. He also revealed at the time that the term ‘metaverse’ isn’t used at Apple because the average person can’t define “what the metaverse is.”

This, of course, is in stark contrast to Meta, which is sinking billions of dollars into developing, and dominating, the metaverse space, with its Quest headset being the first physical representaion of its own vision. Given that it is priced some four times cheaper than the Vision Pro this could see metaverse trump AR in the initial skirmishes, but if Apple can deliver on its AR promise then the metaverse may indeed be consigned to the ‘hype’ dustbin over time…as long as the price comes down.

MtGox Hackers Identified

The US Department of Justice last week unsealed indictments against two Russians it says hacked the MtGox exchange between 2011 and 2013 in what remains the most famous hack in Bitcoin’s history.

Despite nine years’ worth of investigations in Japan and the US, it was never disclosed who had carried out the theft of 650,000 bitcoins, but the task force set up to investigate the hack and the resultant money laundering efforts revealed that it had in fact identified the two individuals in 2017 but only chose to unseal the indictments last week.

MtGox was based in Tokyo, Japan, and was handling the majority of Bitcoin transactions at the time of its collapse in February 2014. Following months of complaints about delayed bitcoin withdrawals, the exchange suddenly halted all withdrawals on February 25, citing a technical issue.

However, it soon became apparent that the exchange had been hacked, resulting in the theft of approximately 650,000 bitcoins, worth around $450 million at the time. The hack had gone undetected for two and a half years, and the stolen bitcoins were taken from both the exchange’s hot wallets (online storage) and cold wallets (offline storage).

A subsequent investigation revealed significant mismanagement and security flaws within the exchange, with owner Mark Karpelès pinpointed as the potential thief. However, attention soon turned to Russian hackers and launderers, and in December 2017, four months after the arrest of Russian money launderer Alexander Vinnik, a grand jury indicted Russians Aleksandr Verner and Alexey Bilyuchenko in the hack of MtGox and subsequent laundering of the 650,000 bitcoins.

Why the indictments were only unsealed last week after two and a half years is unknown, but the odds of catching the two alleged perpetrators are low: both are Russian nationals living in the country, with Bilyuchenko currently on trial for stealing $400 million worth of cryptocurrencies from an exchange he founded in 2017.

Coinbase and Binance Hit With SEC Charges

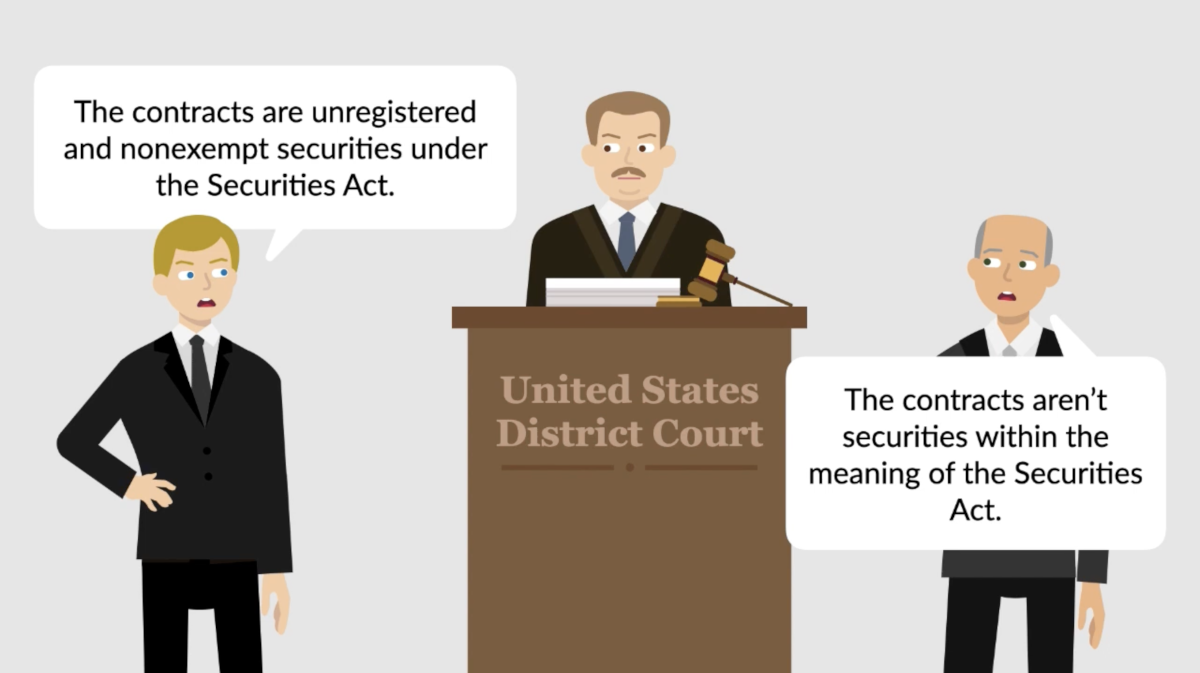

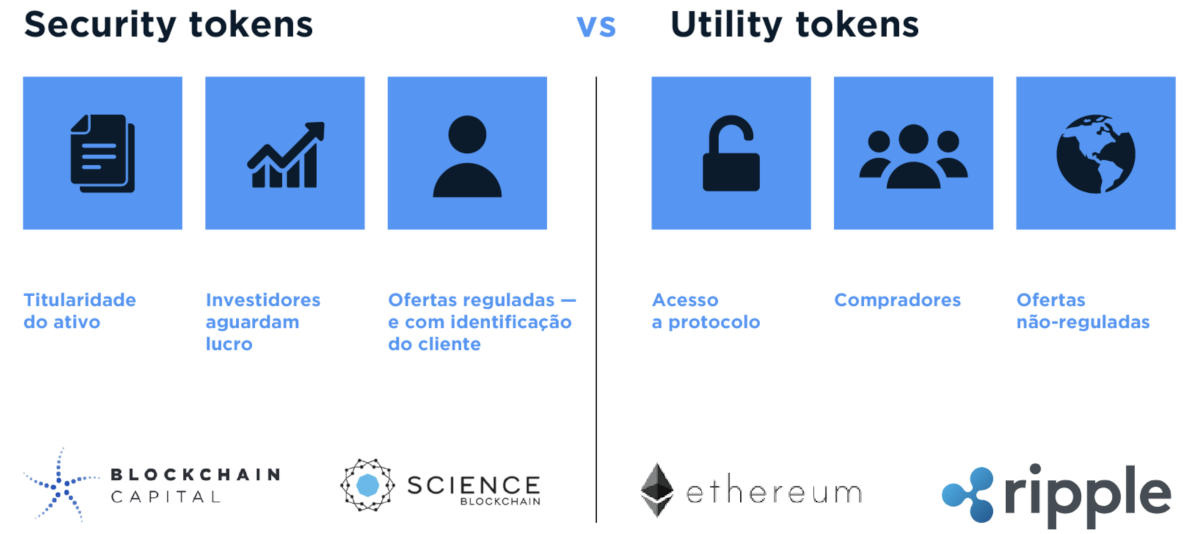

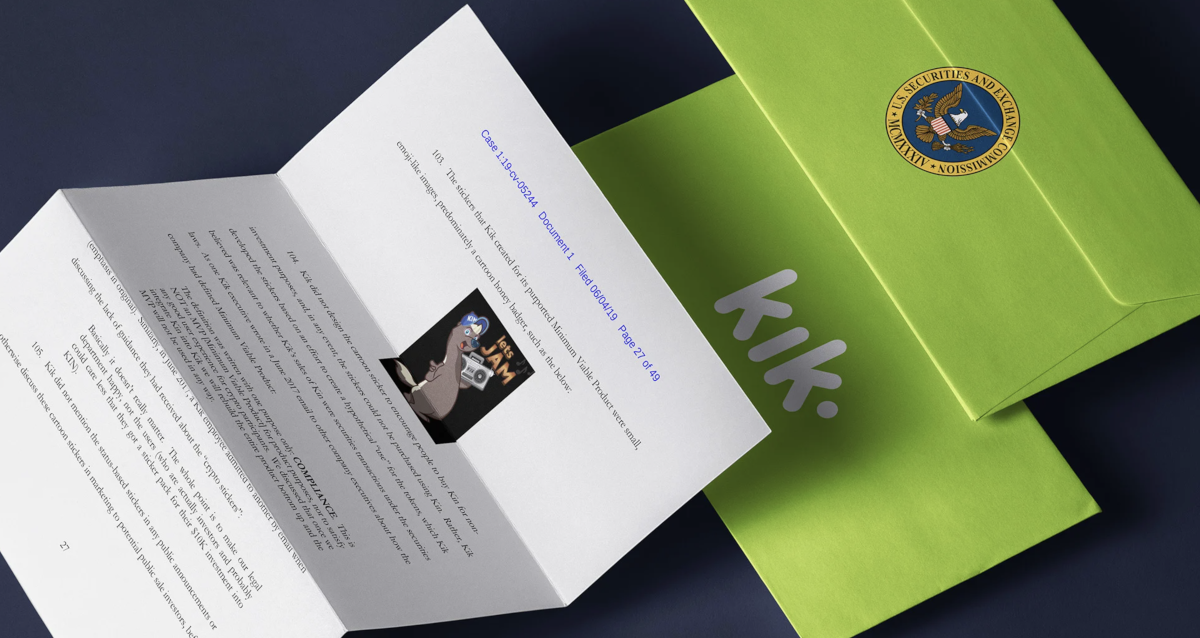

Binance and Coinbase both felt the wrath of the Securities and Exchange Commission (SEC) last week as they were hit with charges of selling unregistered securities and operating unlicensed brokerages. Binance was also hit with charges of intentionally circumnavigating KYC/AML reporting requirements, with the regulator seeking to ban Binance and its US wing, Binance.US, from operating in the country. Binance US also faced a freezing order on its assets just two days later.

In its filings, the SEC pointed to a number of cryptocurrencies it believes are securities that Coinbase in particular was accused of selling, repeating prior actions without giving the operators of the blockchains associated with those coins a chance to respond to the accusation. The moves represented an escalation of the ‘regulation by enforcement’ approach that the SEC has taken to adopting since Gary Genlser joined as chair in April 2021.

Many in the crypto space believed that the charges were inevitable and simply bear out the SEC’s desire to stamp out crypto use in the country rather than safely regulate it, and its decision to tackle the two biggest cryptocurrency exchanges in the world certainly plants a flag in the ground as far as its ambitions go. Both exchanges have said that they are determined to fight the charges, which will make the next few years pivotal ones in the crypto space.

Trending stories:

- Crypto custodian BitGo announced the takeover of rival Prime Trust following rumors that it was on the verge of bankruptcy.

- The Metropolitan Museum of Art has said it will return $550,000 worth of donations it received from FTX last year.

- Three venture capital firms are suing the founder of DeFi platform Curve over a “brazen, multi-faceted scheme” to defraud them and enrich himself.

Guess The Price of Bitcoin and Win 50 Free Spins

Fancy yourself a bitcoin aficionado? Then guess the price of Bitcoin in Punt Casino’s Play The Price promotion. Get it right, and you’ll win 50 Free Spins on Wolf Wild. Even better – no matter what your prediction, you’ll still get a whopping deposit bonus and frree spins, regardless.

Discover the World’s Top Crypto Casino

Looking for the best crypto gambling experience? Check out Punt Casino today for the hottest casino games, bonuses & promotions, and casino tournaments online, with much more to discover every day.

Sign up now with a few quick & easy steps to claim your incredible Punt Casino Welcome Package – a 150% BONUS + 15 FREE SPINS on the popular Gods vs Titans!

You can also enjoy daily bonuses and unique promotions with new offers up for grabs on a daily basis, with new free spins, bonuses, and cashback deals on a frequent basis. Visit the Promotions Page now for the biggest bonus deals and promos on offer today.

Choose from 1,000+ mind-blowing casino games including slots, table games, poker, video poker, and specialty Bitcoin games, with huge jackpots and gigantic payouts waiting to be won today.