Get the top crypto news stories weekly, right here, with Crypto Espresso.

Are Crypto Winnings Taxed? Crypto Gambling Taxes Explained

August 15, 2022

Are Crypto Winnings Taxed? Crypto Gambling Taxes Explained

August 15, 2022

Crypto Gambling Taxes: Are Crypto Winnings Taxed and What Are the Rules?

So you’ve been winning big in our best crypto casino games and you’re thinking about how you’re going to spend all that extra cash. But just as the excitement hits, a sudden realization strikes you like a punch in the gut – do crypto gambling taxes apply, and will the taxman want his cut?!

Now, we all know the answer to that last question will always be YES. But, since you’re playing with crypto, are you obliged to declare your winnings and pay taxes on crypto gambling? There are many factors to consider when it comes to online gambling and taxes, and it’s best to do your research to stay within the lines of the law.

The legality of cryptos and online gambling

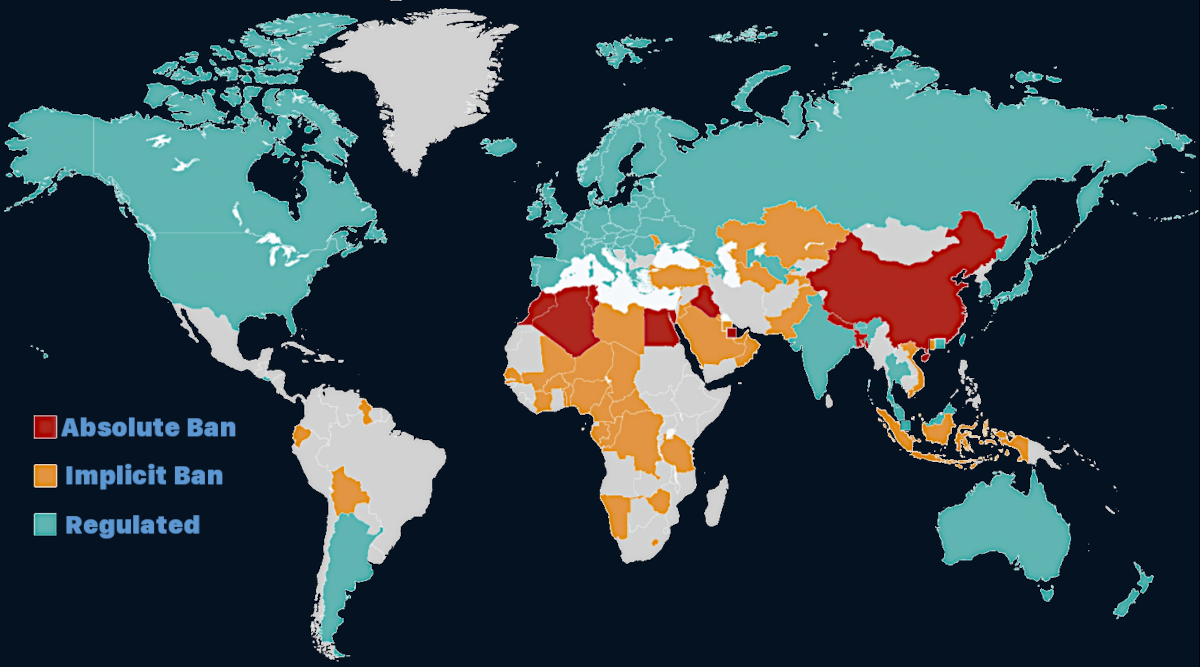

Before you can find out whether or not you’re eligible for gambling crypto tax, you will need to establish if the use of crypto is legal in your country and if online gambling is permitted in your jurisdiction. Hopefully, you’ve done this even before playing, but if not, you better get to it.

Believe it or not, there are actually countries where the use of crypto is banned or restricted, such as Algeria, Bangladesh, China, Egypt, Morocco, Nepal, and Tunisia to name a few.

Countries and regional economies where cryptos are banned or regulated (as of Nov 2021)

The same can be said for online gambling. Some countries have zero restrictions and taxes on online gambling may not even apply, while others have strict laws and regulations in place. There are even some countries that don’t permit online gambling in any form, at all.

The most complicated country when it comes to online gambling law is probably the United States. Although there are no federal laws and legislations around crypto gambling as yet, there is certainly a lot of state legislation for online gambling overall. So if you want to know if crypto gambling taxes apply to you, make sure you’re on the right side of the law – not left or right – the right ✔️side.

How cryptocurrencies are taxed

Since crypto is a fairly new form of currency – mainstream, at least, the taxation laws around it are relatively new too. This means that there are still a few grey areas that have not yet been clarified or understood by crypto users. Fair enough. But when the law comes knocking, you’ll need to open up and reveal, so paying your gambling crypto tax is an absolute must.

But you know what they say – only pay the tax man what he’s due! So what are the taxes on online gambling? First, it is important to know that cryptos ARE NOT seen as a legal form of currency (except for in El Salvador). Cryptocurrencies, in the eyes of the law, are handled as property in most countries. And just like the sale of property turns a loss or profit, so does the sale of crypto.

How much your cryptocurrency will be taxed depends on your profit margin. In the United States, for example, Capital Gains Tax applies to all crypto earnings. This means that you will only be taxed on the profit of your investment. For example, if you buy BTC for $1,000, and you sell it later for $5,000 – that means you’ll be taxed on the $4,000 profit.

How do crypto gambling taxes work?

Of course, the taxes on crypto gambling activities and the percentage you will be taxed depends on where you’re from. The United States, China, India, and many other countries apply taxes on online gambling activities, whereas countries like Austria, Australia, Canada, France, Denmark, Germany, and the United Kingdom, among others, don’t.

However, in most countries where tax applies, the taxation laws around tax for online gambling and tax for crypto gains usually differ. This is why there is generally so much confusion around crypto gambling taxes, and how much must be paid to the taxman.

Taxes on online gambling winnings in the US is around 24%, but only if your win exceeds the $600 threshold. But at the end of the day, it all comes down to what you do with your crypto winnings. If you exchange your crypto for fiat currency, Capital Gains Tax will probably apply. But what happens if you decide to reinvest your winnings in crypto, or continue betting?

That’s where deductions come in. As crypto gambling is still seen as online gambling in the US, you can also deduct your losses for online gambling and taxes. Let’s say for example you had a massive win on our jackpot slots of $5,000, but you also have losses accumulating to $2,000. This means you’ll only need to pay tax on the $3,000 difference.

However, these processes are generally quite complicated and it’s best to seek advice from a real tax consultant (not us) in order to consolidate your taxes on crypto gambling correctly.

Why gamble using crypto?

Finally – an easy question to answer! Yes, gambling crypto tax may still apply depending on where you’re from, but crypto gambling does offer benefits over traditional online gambling. Let’s take a look at some of the best advantages of crypto gambling.

Instant deposits and faster withdrawals

Thanks to the speed at which crypto transactions are confirmed on the blockchain, you’ll be able to deposit your funds instantly and start playing right away. Punt Casino accepts deposits and pays out winnings in various cryptos such as Bitcoin, Bitcoin Cash, and Litecoin to name a few.

And when you’re ready to cash out, you won’t have to wait for third-party payment providers or banks to release your funds. All winnings are paid straight into your crypto wallet after your withdrawal request has been approved – you’ll never be late to pay those crypto gambling taxes ever again!

Cheaper transactions

Deposits and Withdrawals using Bitcoin and other cryptos are far cheaper than fiat – period! That means you’ll be saving on transactions and you’ll have more credits to play our stellar selection of crypto-friendly casino games and save you some money for paying your taxes on online gambling.

And there’s more where that came from. Visit our games menu today for the best crypto slots, table games, video poker, specialty games, and more – all waiting when you’re ready to score.

Crypto banking is safer and private

When it comes to online gambling and taxes, you want to make sure that all your online banking is done safely and securely. Thanks to the higher levels of anonymity associated with crypto banking, your online crypto transactions at Punt are far safer than using fiat currencies.

Why? Because you won’t need to provide any banking information or extensive personal info – all we need is an email address and a crypto receiving address to pay out your winnings.

Bigger bonuses – what more do you need?

It’s no secret that crypto casinos generally offer larger deposit bonuses and welcome packages than traditional online casinos. Will your casino bonus count for crypto gambling taxes? Only if you come out a winner, but if you’ve seen our Promotions menu lately, winning shouldn’t be a problem.

As you can see, there are many benefits to gambling with crypto, and you can take advantage of all of them right here at Punt.

Crypto Gambling Taxes: Summary

- Even though cryptocurrencies are not seen as legal tender, taxes on online gambling may still apply to crypto casino winnings, depending on the country you are from.

- The United States, Spain, Mexico, China, and India are among the countries where taxes on crypto gambling may apply.

- Countries such as Belgium, Austria, Bulgaria, Australia, Canada, France, Denmark, Germany, Italy, the UK, and Malta don’t apply tax to winnings accrued from online gambling.

- In the United States as a whole, there are no federal taxation laws or legislations around crypto gambling yet, but state legislation and taxation laws do apply to online gambling.

- The tax percentage for winnings from online gambling in the US is around 24% if your win exceeds the $600 threshold amount.

- In the case of gambling crypto tax, Capital Gains Tax may apply as crypto is not deemed currency, but rather as property.

- It’s best to seek advice from a tax consultant in your jurisdiction to determine the amount of tax that must be paid, as the type of tax will depend on the laws in your country, and your specific circumstances – in most cases, at least.

Always keep crypto gambling taxes in mind

So, in short, online gambling and taxes do go hand-in-hand, even if you’re playing online casino games with crypto. The best route to follow is to research the tax laws in your jurisdiction to figure out which type of tax you should pay, and exactly how much.

Remember, in some parts of the world you can also claim losses back against your taxes on crypto gambling, but consult professional advice if you’re sitting with a large sum. Well, that’s it from us. Good luck with your crypto gambling taxes and remember – only pay the tax man what he’s due!

Ethan

With over a decade in the online gambling industry and a passion for all things crypto, Ethan offers valuable insight into playing at Punt with in-depth reviews, gambling guides, and informative content to help our readers make the best of their Punt Casino experience. Get all the ins and outs of crypto gambling with Ethan and our team of gambling experts right here, on the Punt Casino blog.