Keeping up with cryptos? Check out the latest crypto news very week on the Punt Casino blog.

Guess The Price of Bitcoin And Win 50 Free Spins

June 12, 2023

Guess The Price of Bitcoin And Win 50 Free Spins

June 12, 2023

Pick To Predict! Guess The Price of Bitcoin And Win

Guess The Price of Bitcoin and win big in Punt’s first-ever Play The Price promotion.

Table of Contents

-

- Guess The Price: How To Win 50 Free Spins

- Bitcoin’s Price History

- Bitcoin Price Prediction 2023

- Bitcoin Price Predictions from 2022

- The Future Of BTC: Bitcoin Price Predictions 2024 And Beyond

- Factors Influencing Bitcoin’s Value

- Timing and Opportunities: What It Means to Invest in BTC Now

- FAQ

Guess The Price: How To Win 50 Free Spins

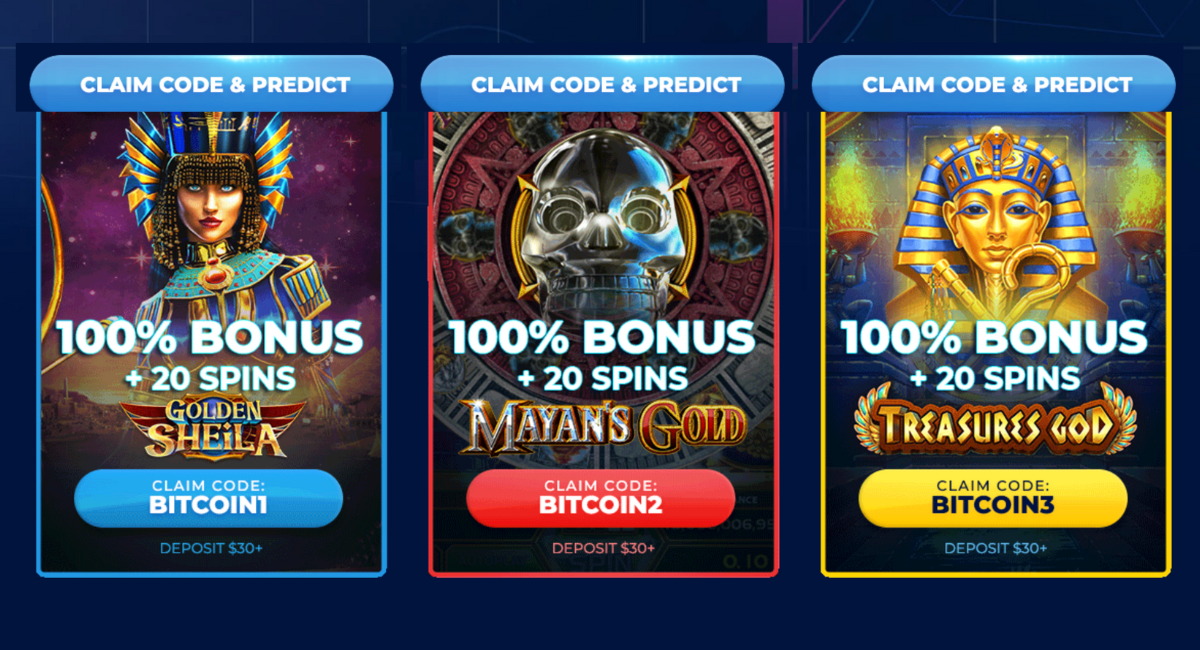

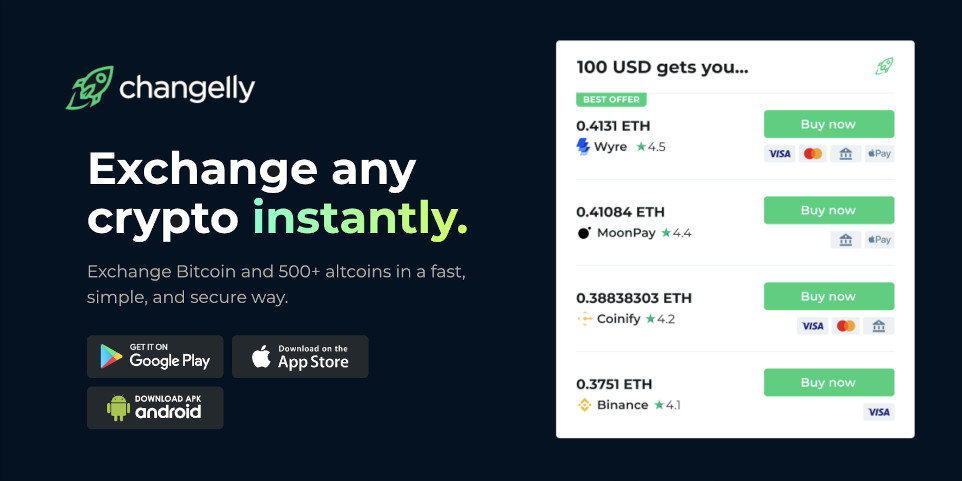

Got a knack for knowing Bitcoin trends? Select your bonus based on its corresponding BTC price prediction to win 50 FREE Spins!

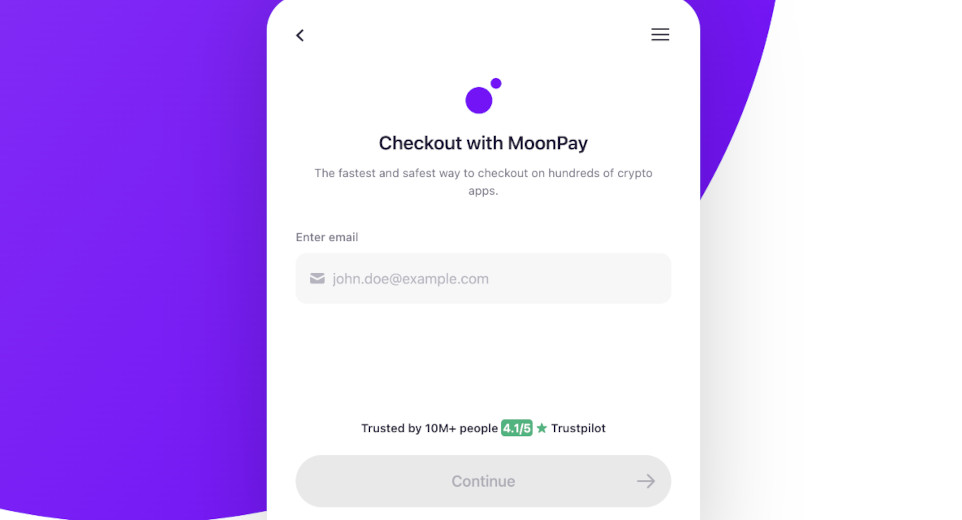

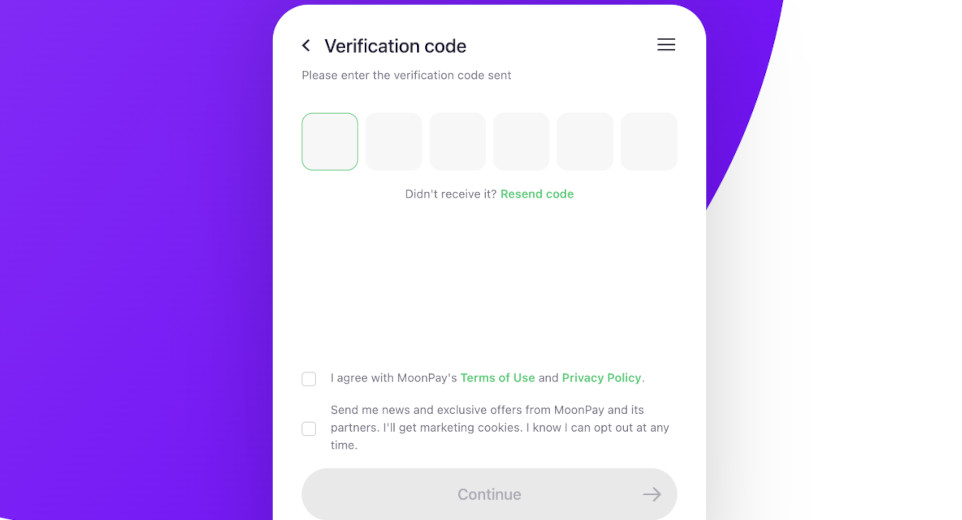

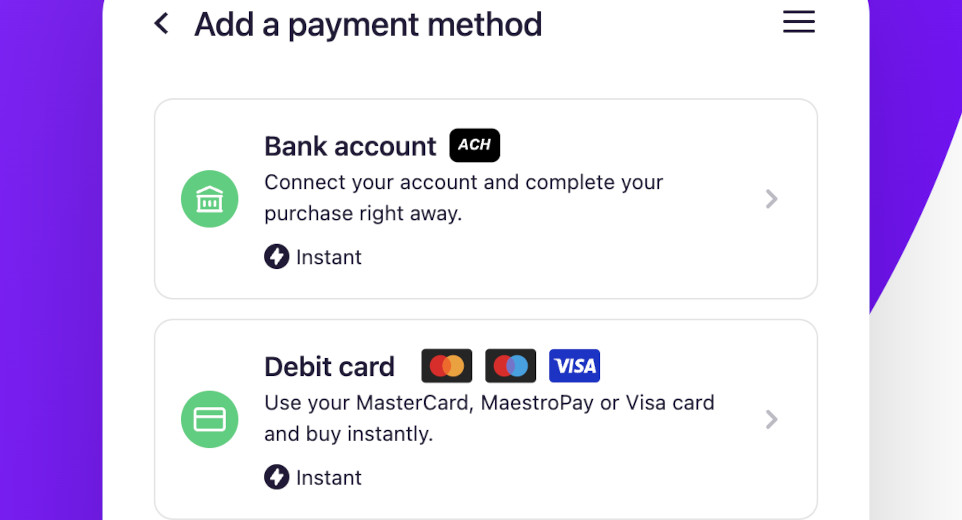

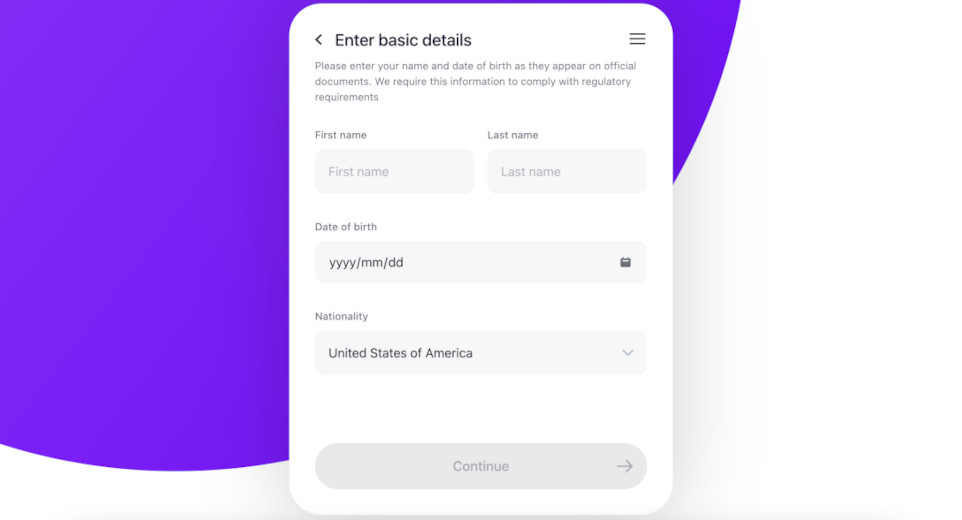

Punt Casino is launching a first-ever Play the Price promotion. Participants can guess the price of Bitcoin, and those who guess correctly will win a whopping 50 free spins on the captivating slot, Wolf Wild.

How To Play:

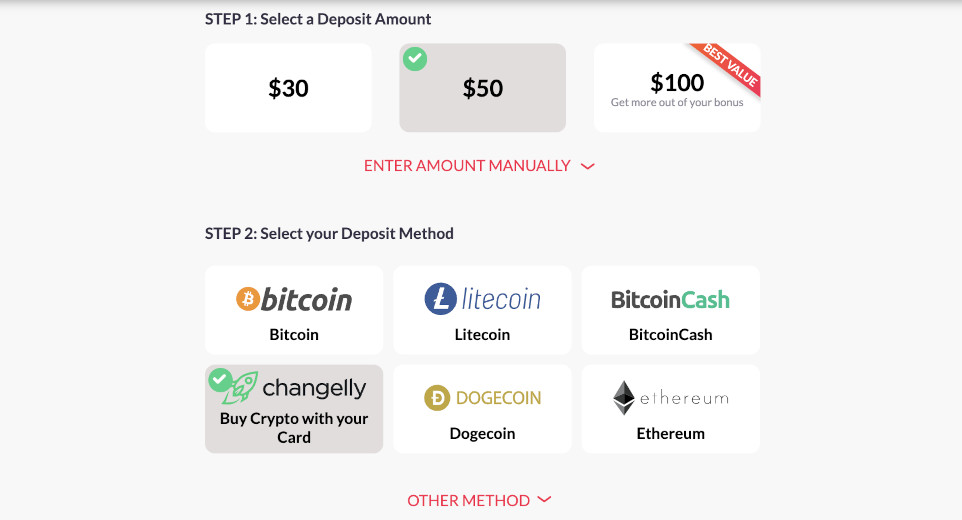

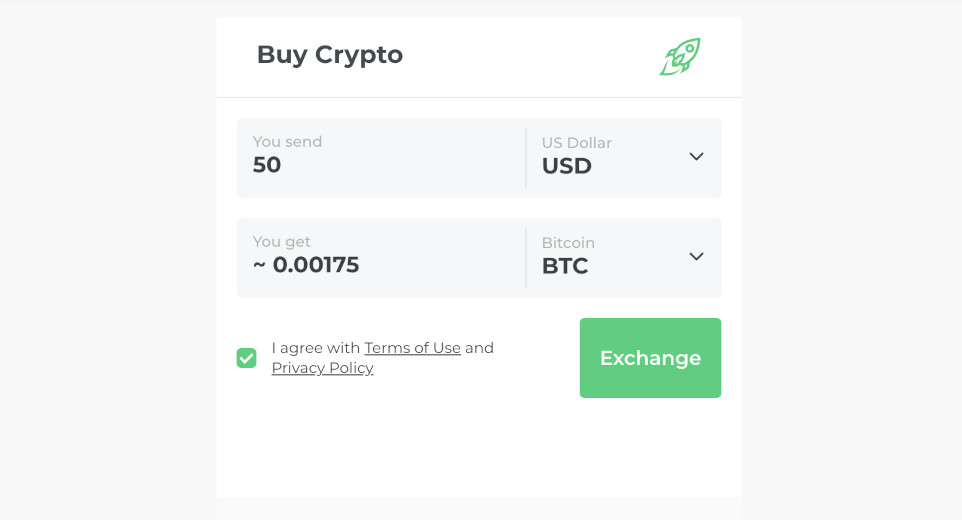

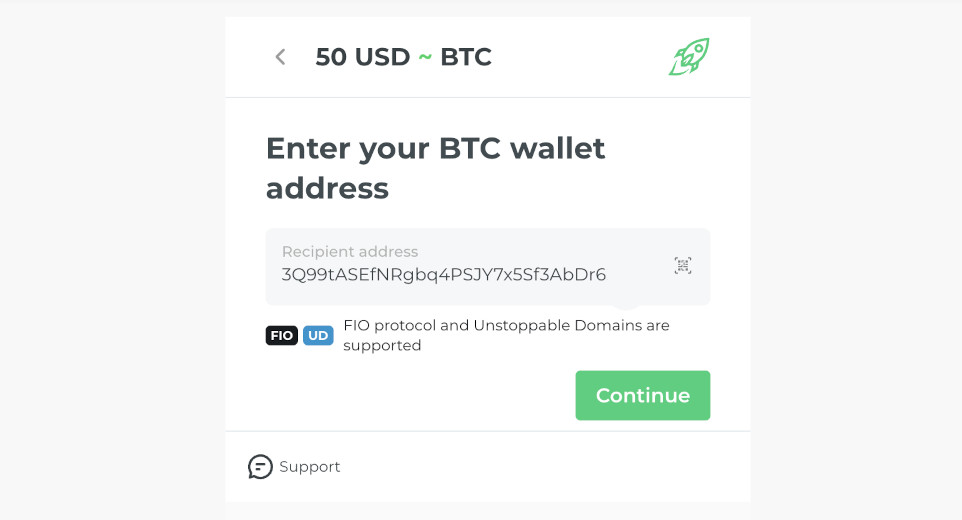

- Click here to take part

- Choose your bonus based on its corresponding bitcoin price prediction – these value will be displayed at the top of each bonus

- The closest bitcoin price prediction wins 50 Free Spins on Wolf Wild. This is ON TOP of your Bonus and Spins offer

The Bitcoin price prediction counter stops on 21 June (23:59 EST), so you don’t have much time to get those votes in.

If you’re excited to get involved, but don’t know how to go about BTC price predictions, we’ve got some tips. In this blog, we’ll cover Bitcoin’s price history, which factors influence the BTC price, as well as price predictions from 2022. Let’s jump right in

👇

Bitcoin’s Price History

Bitcoin, the first-ever cryptocurrency, has experienced a volatile journey since its inception in 2009. The price of Bitcoin has seen significant highs and lows, reflecting various factors such as technological advancements, regulatory developments, macroeconomic trends, and shifts in market sentiment.

According to data from CoinMarketCap, as of June 11, 2023, the price of Bitcoin stands at $26,012.50.

Bitcoin Price Prediction 2023

Predicting Bitcoin’s price is challenging. This is primarily due to its volatility, and the influence of various factors.

However, several sources have made predictions for Bitcoin’s price in 2023:

-

- Forbes Advisor: They predict that Bitcoin could reach $100,000 by the end of 2023, driven by increasing adoption, technological advancements, and macroeconomic factors.

- Evening Standard: They suggest that Bitcoin’s price could slowly increase due to the upcoming Bitcoin halving event in April 2024. The halving event, which reduces the reward for mining new blocks, could create a supply squeeze if demand remains strong.

These predictions should be taken with caution as they are based on current trends and assumptions, which can change rapidly in the cryptocurrency market. But it doesn’t hurt to have a little help 😉

Bitcoin Price Predictions From 2022

In 2022, various sources made predictions about the future price of Bitcoin. Here are some of the top predictions:

- Forbes Advisor: They predicted that Bitcoin could reach $100,000 by the end of 2023, driven by increasing adoption, technological advancements, and macroeconomic factors.

- Evening Standard: They suggested that Bitcoin’s price could slowly increase due to the upcoming Bitcoin halving event in April 2024. The halving event, which reduces the reward for mining new blocks, could create a supply squeeze if demand remains strong.

- Capital.com: They provided a summary of Bitcoin’s price in 2022 and key data points. Bitcoin saw a recovery in 2023 after a challenging 2022, breaking above the $30,000 mark in April 2023. The coin had previously sunk to a low of $15,682.69 on November 9, 2022, after the collapse of the FTX (FTT) exchange.

Key Data Points:

| Date | Bitcoin Price |

|---|---|

| 9 November 2022 | $15,682.69 |

| 10 November 2022 | $18,054.31 |

| 12 December 2022 | Below $17,000 |

| 16 February 2023 | $25,134.12 |

| 10 March 2023 | $19,628.25 |

| 14 April 2023 | $31,005.61 |

| 18 April 2023 | $29,900 |

| June 12, 2023 | $26,540 |

Summary: Bitcoin (BTC) has seen a recovery in 2023 after a challenging 2022, breaking above the $30,000 mark in April 2023. The coin had previously sunk to a low of $15,682.69 on 9 November 2022 after the collapse of the FTX (FTT) exchange. Despite a sustained rally over $17,000 in early December, it was below that figure on 12 December 2022. As of 12 June 2023, Bitcoin was trading around $26,540

The Future Of BTC: Bitcoin Price Predictions 2024 And Beyond

Different sources have different predictions for the future price of Bitcoin:

- CryptoPredictions.com predicts that BTC could close 2023 at $27,042.45, and fall to $25,750.01 by the end of 2024.

- DigitalCoinPrice predicts a fast pace of growth, with the price potentially averaging $104,054.68 in 2025 and hitting $308,121.08 in 2030.

- Wallet Investor predicts that the coin could drop down to trade at $12,078.42 by 18 April 2024.

What Factors Influence Bitcoin’s Value?

Bitcoin’s value is influenced by several factors:

- Supply and Demand: The total supply of Bitcoin is capped at 21 million, creating a scarcity that can drive up prices. Demand is influenced by the number of people buying Bitcoin, which can be indicated by the number of daily transactions and active Bitcoin addresses.

- Competition: Despite the emergence of altcoins, Bitcoin remains the largest cryptocurrency by market capitalization. Its position could be influenced by the success of altcoins, particularly those offering unique features.

- Sentiment: The market sentiment towards Bitcoin can significantly impact its price. Tools like the Crypto Fear & Greed Index can provide insights into the current market sentiment.

- Regulatory Environment: Regulations can impact the adoption and usability of Bitcoin, influencing its price.

Timing and Opportunities: What It Means to Invest in BTC Now

Investing in Bitcoin now means entering a market characterized by high volatility and potential high returns. With the upcoming Bitcoin halving event in 2024, there could be potential price increases due to the supply squeeze. Potential investors should always do their research beforehand, while keeping up to date with Bitcoin trends and news. Punt’s Crypto Espresso feature is the perfect place to stay in the loop.

FAQ

What is Bitcoin?

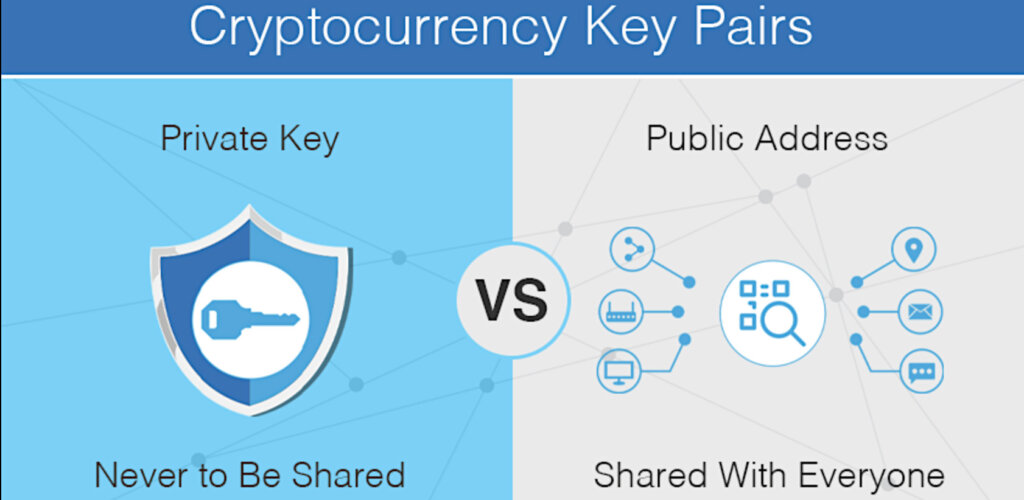

Bitcoin is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. Find out more about using bitcoin at Punt Casino here.

How is the price of Bitcoin determined?

The price of Bitcoin is determined by supply and demand. This means that the price increases when the demand for Bitcoins grows, and it decreases when the demand falls. Other factors that influence the price include competition from other cryptocurrencies, market sentiment, regulatory news, and technological advancements.

What is the Punt’s Play the Price promotion?

Punt’s Play The Price promotion gives players the chance to guess the future price of Bitcoin. Those who guess correctly will win 50 free spins on the popular slot, Wolf Wild. The step-by-step instructions on how to participate can be seen above. YOU could be a winner!

What are the risks of investing in Bitcoin?

Investing in Bitcoin, like any other investment, comes with its own set of risks. The price of Bitcoin is highly volatile and can change rapidly. Therefore, it’s possible to experience significant losses. Always do your own research and consider your risk tolerance before investing in Bitcoin.

What is a Bitcoin halving event?

A Bitcoin halving event is when the reward for mining new blocks is halved, meaning that miners receive 50% fewer Bitcoins for verifying transactions. Bitcoin halvings are scheduled to occur once every 210,000 blocks – roughly every four years – until the maximum supply of 21 million Bitcoins has been generated by the network.

How accurate are Bitcoin price predictions?

Bitcoin price predictions are based on current data and trends. However, the cryptocurrency market is highly volatile and influenced by many factors, making it difficult to accurately predict the future price of Bitcoin. Therefore, these predictions should be taken with caution.