Last week’s biggest crypto news with a special bonus deal inside.

This Week’s Crypto Espresso – Biggest Crypto News Weekly

June 19, 2023

This Week’s Crypto Espresso – Biggest Crypto News Weekly

June 19, 2023

Biggest Crypto News Stories Last Week:

Last week in the crypto world we saw BlackRock file for a Bitcoin ETF, Binance.US succeed in protecting its assets from being frozen, and a UK court date set which will decide the claims of a famous Satoshi Nakamoto candidate.

Satoshi Nakamoto ‘Identity’ to be Ruled on in 2024

The identity of Bitcoin founder Satoshi Nakamoto may or may not be decided in a UK court next January after a British judge ruled that a preliminary single-issue trial over the matter will take place following multiple lawsuits by pretender Craig Wright.

Wright currently has more than ten court cases going through various UK courts at the moment, all of which are predicted to some extent on whether he is Satoshi Nakamoto or not, and so the judge in charge of four of them has decided to settle the matter once and for all before they get to trial.

Wright has been claiming to be Bitcoin’s pseudonymous creator since 2014, with his claims made public in 2015. However, accusations of lies and forged documents have dogged his every attempt to convince the crypto world of his claim, to the point where he has resorted to suing critics, developers and cryptocurrency exchanges in the hopes that a UK judge will find in his favor. This would force institutions to adopt his Bitcoin fork, BSV, as the real Bitcoin, confirming his candidacy as Satoshi in the process.

In a London court last week, the judge in four of Wright’s cases called multiple parties together to discuss how the core issue, whether Wright is Satoshi or not, could be decided once rather than ten times. The result will be a mini-trial as part of the lawsuit filed against him by the Crypto Open Patent Alliance (COPA), which contends that he is not Satoshi and intends to prove it, which will take place in January 2014.

The result of this element of the case will, once decided, be binding for all his other UK lawsuits, setting the seal once and for Wright’s desire to be recognised, in a legal sense at least, as Bitcoin’s founder.

BlackRock Files for Bitcoin ETF

Investment giant BlackRock last week filed for a Bitcoin ETF in a move that raised many eyebrows given the treatment meted out to the cryptocurrency market by regulators in recent months. The world’s largest money manager, boasting $9.1 trillion of assets under management, filed a preliminary prospectus for the iShares Bitcoin Trust with the Securities and Exchange Commission (SEC) last Thursday, with Coinbase named as its custodian.

This, too, was a surprise, not because Coinbase had been chosen at all (Coinbase and BlackRock signed such a deal last year) but because the SEC is targeting Coinbase over alleged illegal sales of securities.

The SEC has rejected every Bitcoin ETF application to date, emphasizing concerns about the safety of Bitcoin for retail investors, although it has allowed Bitcoin futures ETFs. These rejections have even come the way of giants like the Chicago Board Options Exchange, with the SEC worried about fraudulent and manipulative practices and participant safety, which it attributes to the lack of transparency in the underlying spot Bitcoin market.

BlackRock is by far the biggest name to apply for a Bitcoin ETF, which it calls the iShares Bitcoin Trust, and it seems that it hopes its name and reputation will be enough to see it through. However, the SEC has been repeating the same concerns in recent rejections that it did when it rejected the first Bitcoin ETF from the Winklevoss twins in 2017, so unless BlackRock can address these core criticisms from the SEC, which has only grown more anti-Bitcoin during that time, its name alone may not be enough.

Binance.US Avoids Asset Freeze

Binance.US, the US wing of the Binance empire, avoided the “death penalty” its lawyers warned against after a Washington judge stated that there was “absolutely no need” to freeze its assets. Instead, Binance, Binance.US and the SEC announced a deal on Friday which will ensure that only Binance.US employees can access customer funds in the short term, with the SEC’s main concern being that Binance would seek to move the assets outside of the US following the agency’s lawsuit last week.

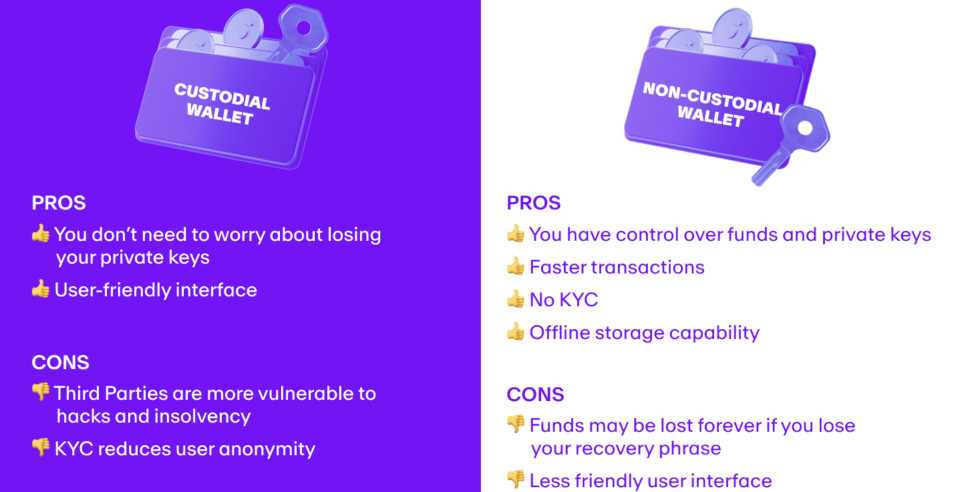

The SEC had sought the freezing of all Binance.US assets following its lawsuit over the sale of unregistered securities, misappropriation of funds and AML/KYC violations, a move which Binance.US said was draconian in nature and would mean that it couldn’t pay its bills or staff salaries.

The judge agreed, suggesting that the two should work out a deal where the funds were kept out of Binance.US’s direct control but which still allowed the company access to pay for essentials. This has now been agreed.

While Binance.US may have saved itself from going under, it has nevertheless adopted some cost-saving measures, with staff reporting job cuts on social media as the entity prepares for a potentially long and costly battle with the SEC; some reports said as many as 50 staff have been laid off in preparation for the fight ahead.

Trending stories:

- North Korean hackers are posing as remote engineers in order to infiltrate crypto companies, according to the security analysts.

- US Representative Warren Davidson last week formally tabled a bill calling for the removal of SEC Chair Gary Gensler.

- Crypto investment firm a16z Crypto is to open a UK office after praising the approach taken by the UK government to web3 and crypto development.

What to Look Forward to This Week:

With daily bonuses and special offers coming your way every day this week, there’s more enough action to go around. Dn’tmiss out on the Book of Billionaire Tournament from Fugaso – where you could WIN A SHARE OF $134,000 + A GRAND PRIZE OF $10,000 WEEKLY. But there’s more! Check out the Bonuses & Promotions page now to find the best deals on offer today.