Keeping up with cryptos? Check out the latest crypto news very week on the Punt Casino blog.

The Do and Don’ts of Using a Safe Crypto Exchange

February 15, 2023

The Do and Don’ts of Using a Safe Crypto Exchange

February 15, 2023

The Do and Don’ts of Using a Safe Crypto Exchange

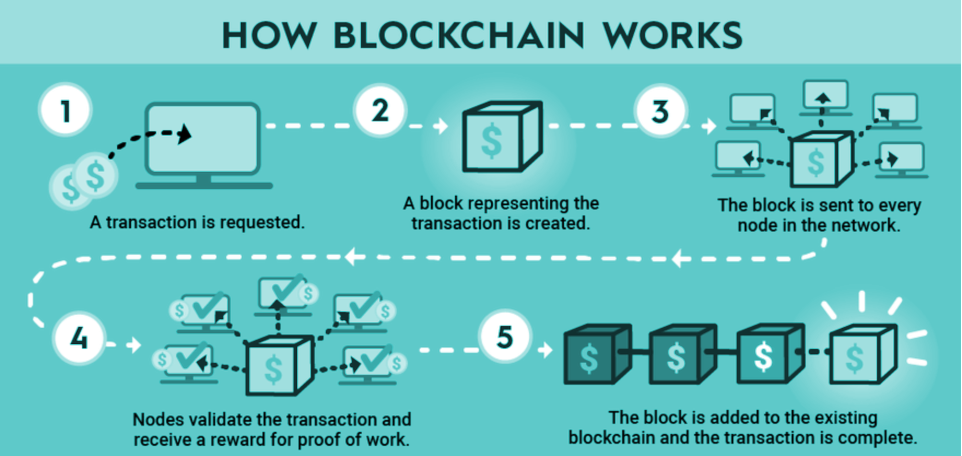

Cryptocurrency exchanges are vital to the continuation of the ecosystem. But, for a first-timer, or even someone who thinks they know their way around them, there are a number of golden rules you should follow in order to make your time on a safe crypto exchange a happy, profitable, and secure one.

Here’s our list of crypto exchange dos and don’ts to ensure you don’t fall foul of the taxman, hackers, and more.

What you should do when using a safe crypto exchange (Dos)

1. Do conduct research before registering

You will probably be handing over your identity documents to any exchange you intend to use more than once, so you need to know they’re trustworthy. Of course, you’ll never be 100% sure (FTX anyone?), but 9 times out of 10 you get a feel for how reputable they are when using them.

It’s not quite the wild west out there anymore, in that very few exchanges are intentionally out there to pull a fast one, but some online sleuthing prior to signing up will help you get an idea of whether or not your potential exchange is a truly safe crypto exchange.

2. Double-check your transactions

If there’s one truism about crypto which applies at all levels, it is that you are in control of your own money. This goes for storage but also for trading, because if you make a mistake when buying or selling then there are no ghostbusters to call.

There are many horror stories of traders who have put in an extra zero by accident, or tapped ‘buy’ rather than ‘sell’, and have decimated their holdings in a split second.

To avoid this fate, double-check each trade before you execute, and don’t rush anything. A slow hand might cost you a few cents, but a ‘fat finger’ could cost you a whole lot more.

3. Do use all available security protocols

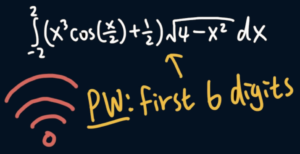

There are several things you should do to minimize the chances of a hack. First, use a brand new, complex password of at least 16 characters that you haven’t used anywhere else.

Okay, it doesn’t have to be THAT complex, but you get the picture…

Second, use two-factor authentication and ensure that you have email withdrawal verification turned on. This means no one can withdraw funds without having physical access to your phone, and you will be alerted if anyone ever tries to take money out.

4. Do use tax software to record your activities

No one likes to pay tax, but the chances are you will have to do so on your crypto gains. There are some great crypto tax software packages out there nowadays that do all the calculating for you and spit out a handy report at the end of the tax year.

It’s well worth adding each exchange to your tax software before you use it. This is as simple as creating an API, and it will save severe headaches down the line.

5. Do keep a whitelist of addresses

It’s a good idea to add addresses you regularly use to a whitelist on your safe crypto exchange of choice. This means that you don’t risk entering it wrong each time you need to, while some exchanges have an option that means you can’t withdraw to a non-whitelist exchange, further increasing security.

What you shouldn’t do when using a crypto exchange (Don’ts)

1. Don’t be greedy!

Unless you’re an experienced or professional trader, you shouldn’t touch the various options that many exchanges throw your way these days, such as leverage, margin, or options trading.

If you really want to learn how to use these functions then dedicate the time to learn how they work before trying them and be judicious with your spending – selling at a loss is one thing, getting liquidated is quite another.

The crypto market is volatile enough without turning it up to 11, so most people should stay away from these temptations.

2. Don’t keep all your funds on there

You should only keep funds you intend to trade with over the next few days on an exchange, with the rest stored safely in an offline wallet. This is to reduce the chance of your account getting compromised in some way or the exchange going offline.

Exchanges are intended to be a place where you can swap one cryptocurrency for another, not where you store your coins long term.

3. Don’t publicize your success

You’ve just made a life-changing amount of money – congratulations! If you want to keep it that way, don’t boast about it on social media. You will soon find yourself attracting the wrong sort of attention, such as social engineering or phishing attacks aimed at getting into your exchange account and swiping your earnings.

Hackers are clever than ever, and they will play the long game if they suspect you of having a great deal of money in your account, so don’t give them the opportunity to find out.

4. Don’t be wedded to one safe crypto exchange

While some crypto exchanges are certainly better than others, you shouldn’t limit yourself to just one or two – doing that will mean you miss out on the best gains.

Projects generally don’t launch on the likes of Binance straight away; instead, they find homes at smaller exchanges and grow from there.

If you’re looking for the best gains, you’re going to have to go farther afield and register with some smaller exchanges, which is absolutely fine, providing they fulfill your criteria of trustworthiness.

5. Don’t download more apps than you need to

Most reputable exchanges have an app these days but don’t install it on more devices than you will use on a regular basis. Each app you install it on is another potential security risk if you don’t check it very often, so just keep it to the one or two devices you use most often.

Also, make sure those devices have a fairly good malware and antivirus program on them.

Start using safe crypto exchanges today!

As you can see, some of these rules are common sense and some are specific to the crypto world, but all of them will make your use of crypto exchanges a much smoother process.

We wish you happy, and safe, trading.