Global economy, inflation, monetary policies, geopolitics, and Bitcoin’s inflation-hedging potential may influence its July 2023 price. This blog explores these topics in depth.

The Future of Bitcoin Casinos and Online Gambling

February 18, 2023

The Future of Bitcoin Casinos and Online Gambling

February 18, 2023

Is Bitcoin the Future of Online Gambling?

The relation between bitcoin and online gambling, and what the future of bitcoin casinos may look like, is a trending topic due to the fast-growing adoption of cryptocurrencies in the online gambling sector.

Since as early as 2013, online casinos have been making the move toward accepting cryptocurrencies as payment, not only for player deposits but also player withdrawals. This brought about an entirely new breed of online casinos, and with them, a revolution that has changed online gambling forever.

But will this fast-growing trend last? Does bitcoin have a future in online gambling – or is bitcoin the future of online gambling? And if not, will other cryptos or forms of digital currency emerge as the go-to choices for crypto gambling?

Well, we have a few theories – backed by crypto market research and valuable information that may give you some insight into what the bitcoin casino future might look like. But first, let’s look at what bitcoin gambling is doing in today’s world.

The Current State of Bitcoin Gambling

Straight off the bat – recent events in the crypto space have only proven that crypto gambling is here to stay and that the future of bitcoins casinos is a healthy one. Markets have been on the brink of crashing, massive crypto exchanges have been shut down due to unlawful practices, and the crypto community finds itself in uncertain times as a result.

Don’t get us wrong, crypto is not failing – not by a long shot. But of course, growing pains do apply, as with any emerging market.

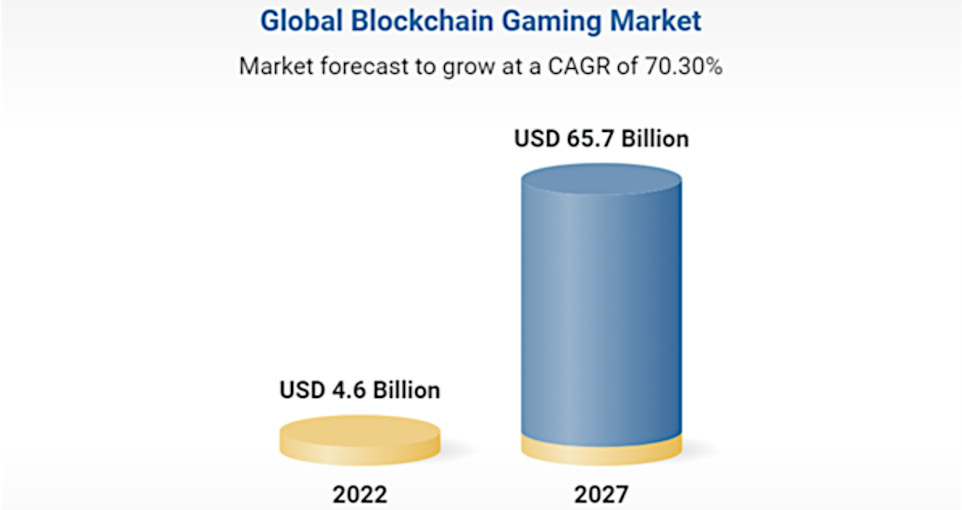

BUT! Even though cryptocurrencies have been facing these challenges of late, crypto gambling, specifically, has been on the rise. But why? Well, according to research, the industry shows a considerable growth rate of just under 11.5% a year.

This is said to continue throughout 2023 all the way to 2030, with predictions pointing at even larger growth beyond.

The latest bitcoin gambling statistics released by casinosblockchain.io in early 2023 state that since the inception of crypto gambling, around 4% of all gambling activity is crypto-related, and players have wagered over $4.5 billion in bitcoin since – that’s only bitcoin, and the majority of this is only in the last few years.

So what does this positive growth for crypto gambling, in specific, mean when comparing it to the not-so-positive growth that crypto markets have experienced lately? Yes, investing in crypto is a volatile game and not for the faint-hearted, but it seems crypto gamblers, in general, are not too phased by current or past events. Let’s find out why.

Why Players Are Choosing Bitcoin Casinos Over Regular Online Casinos

Bitcoin gambling and crypto gambling in general offer various benefits for the player. Yes, the crypto casino also enjoys a few perks, which is another reason why crypto adoption among online casinos is growing at this rate.

But to understand why crypto casino players still prefer using bitcoin and other cryptos for online gambling in such unpredictable times in the crypto market, we should look at the benefits these players enjoy.

Benefits of Bitcoin Gambling

- Instant deposits and much faster withdrawals than fiat currencies

- Cheaper transaction costs than fiat currencies (sometimes only a fraction)

- Improved security when transacting online

- Convenience of payment methods and integrated payment technologies

- Higher levels of anonymity

What this essentially comes down to, is that crypto players know that they can take advantage of these gambling benefits without needing to ‘invest’ in crypto. They are simply using it as a rejection-free, low-cost, safer, and instant payment method, rather than getting stuck in the red tape around centralized currencies issued by central banks and governments.

A player can simply deposit and withdraw using crypto with very few KYC requirements (if any) or restrictions from third-party payment providers. And the best part of all of this is that the gaming experience at crypto casinos is just as good as in traditional online casinos, if not better.

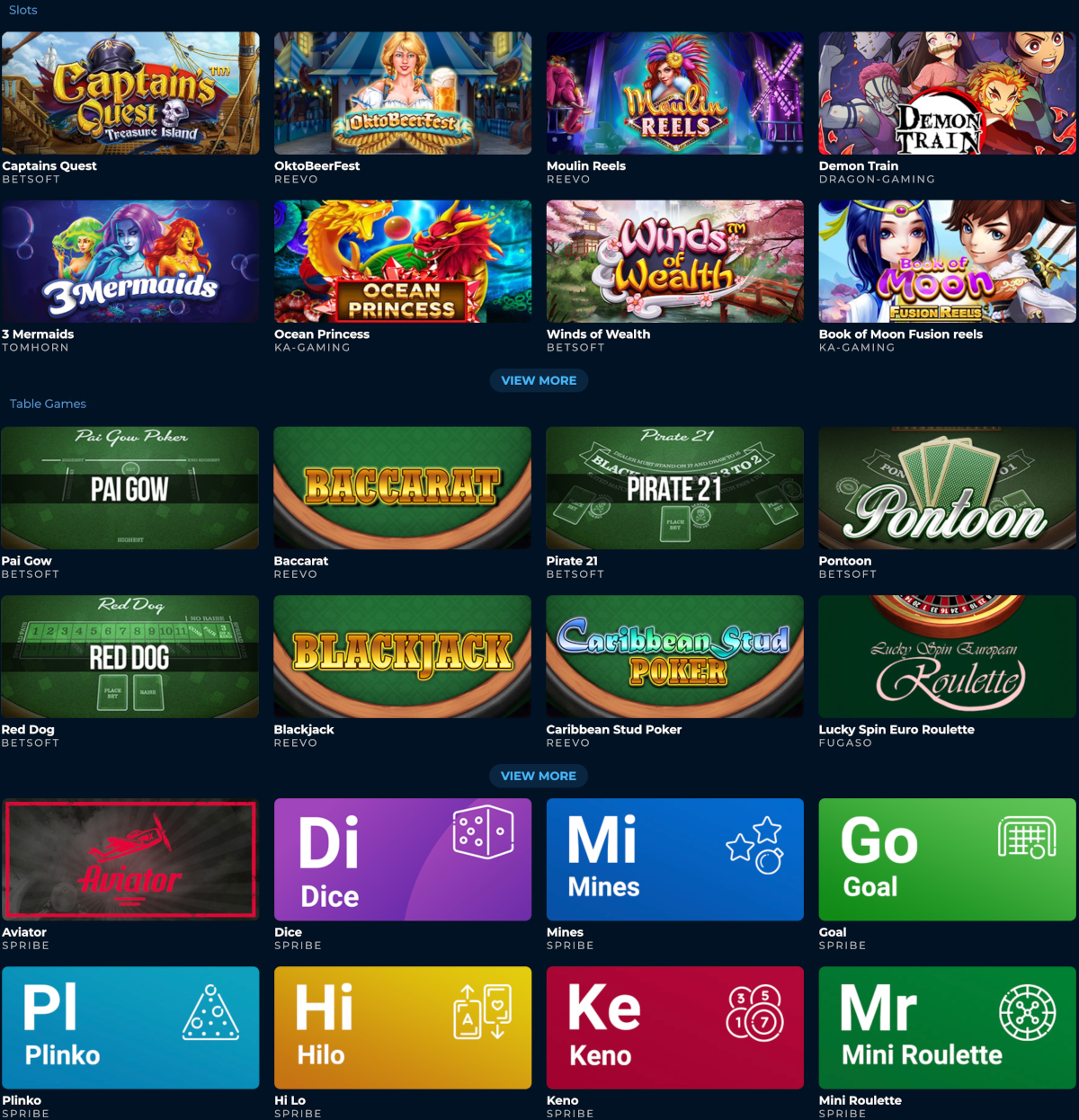

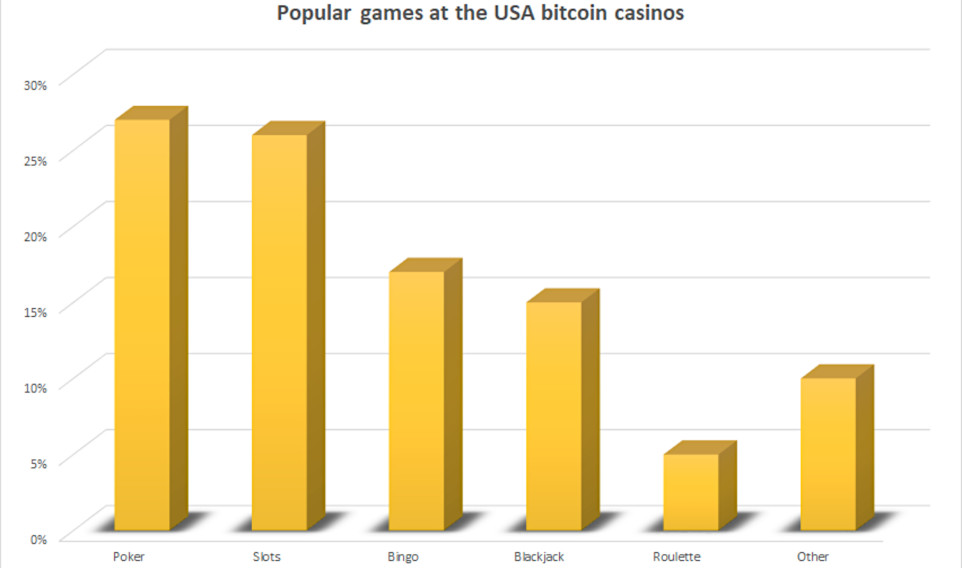

Which bitcoin casino games do players enjoy most? Here’s a look at the most popular bitcoin casino games in the US:

So now that we know why players prefer bitcoin gambling, which games they’re playing, and that crypto gambling is indeed on the rise, let’s take a look at what the future of bitcoin casinos might look like.

The Future of Bitcoin Gambling

Due to the nature of the business, online casinos have always been ahead of the game when it comes to technological advances and online security, finding innovative ways not only to entertain players but also to create a safe and user-friendly environment to do so.

But as the internet and online entertainment world evolved, online casinos needed to keep improving and find new ways to entertain players and ensure that their experience is as unique and seamless as possible, which is a never-ending cycle.

Now, you can imagine this is a very competitive market with new online casinos sprouting up left, right, and center, almost every single day. So if they want to last, they’ve got to get with the program.

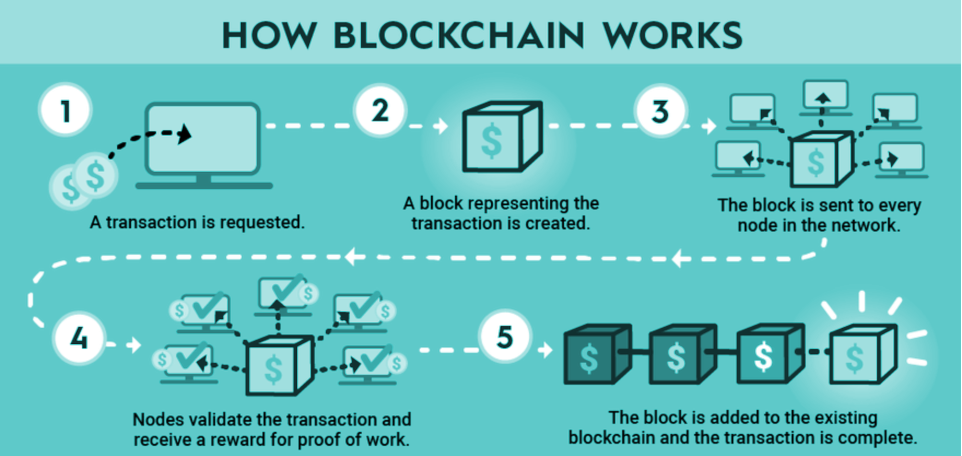

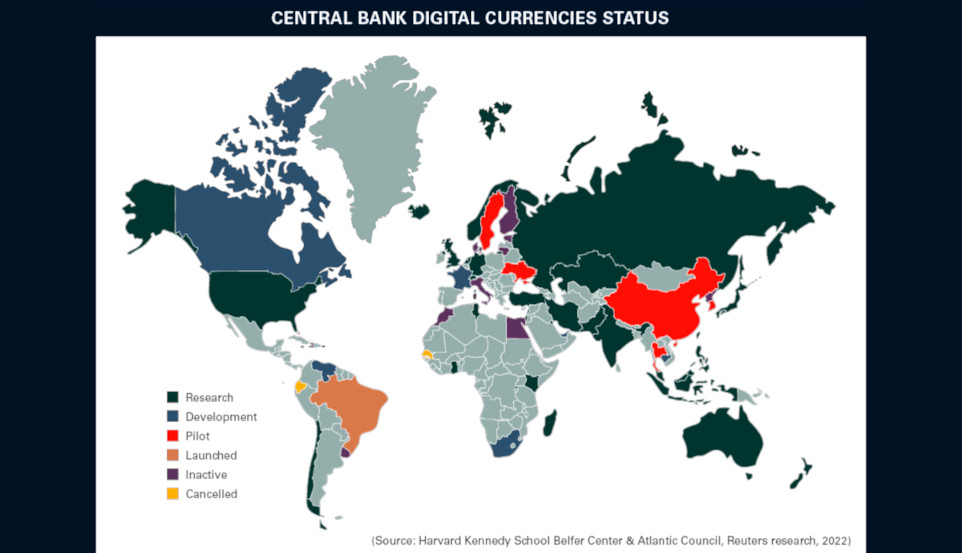

And the new program is without a doubt, crypto. Blockchain and cryptocurrencies are almost certainly the future of online gambling – if not playing a very big part in it. The world is going digital, especially when it comes to finance, and in a digital world, digital currencies reign supreme – hell, even governments are looking into creating their own forms of digital currency.

With the benefits that the technology offers, including security, transparency, cost-effectiveness, and decentralization, it’s easy to see why both players and online casinos are steering in the direction of crypto.

In the US, for example, GamingAmericas.com reported that research conducted by Newzoo shows “around 73.9 million US residents are active users of online and bitcoin casinos. Among them, 52% gamble for real money, and 2.6% are high rollers.”

Now this includes both fiat and crypto casinos, but the ratio will most likely fall in crypto’s favor in coming years, and here’s why we believe why.

Crypto Gambling Trends Shaping the Future of Online Gambling

Blockchain technology and cryptocurrencies are not only becoming prevalent among online casinos but the entire e-commerce sector as well. Putting the current volatile markets aside – the benefits of blockchain tech are starting to creep into every corner of the internet, from gaming to buying goods and services online, and even building decentralized apps and entire Metaverses.

This is good news for crypto gambling and further proves that the bitcoin casino future looks promising. As blockchain technology improves, so do the use cases, which have resulted in numerous trends that will shape the future of online gambling.

Online casino trends in 2023 are one thing, but crypto gambling in particular has its own, unique trends thanks to the nature of the technology behind them. Let’s take a look at a few of the really interesting ones that will most definitely play a big part in the future of bitcoin casinos.

Metaverse Casinos

You may have heard of Decentraland and The Sandbox, which are probably the 2 most popular Ethereum-based metaverse and gaming ecosystems that allow users to share, create, and monetize digital assets and gaming experiences.

In short, they are basically digital worlds that players can access online and interact with each other, buy and create NFTs, purchase digital real estate for advertising, and play games. What if we told you that these digital metaverses also offer casinos? Well, they do.

This is still fairly new in the online gambling world, but you can imagine what a big part metaverse casinos will play in the future of bitcoin casinos. They offer an immersive and interactive casino gaming experience that simulates a real-world casino environment (apart from the frog dealing a poker game, of course).

The key factor to consider here is that all goods, services, and activities in these metaverses are paid for using the in-world digital currency, such as the digital assets token for Dentraland called MANA, or SAND in The Sandbox.

Decentralized Gambling

With the creation of decentralized applications, casinos can offer games on a downloadable platform that can be played using cryptos and can even calculate the outcomes of the games using blockchain technology, which we’ll get to soon.

Decentralized gambling can also be defined as crypto gambling, as you’re using decentralized currencies to wager in casino games. As mentioned, crypto gambling offers many advantages, including safety, anonymity, and cost-effectiveness, and we can certainly see how this would appeal to players, and play a big part in the future of online gambling.

Seamless Payment Methods

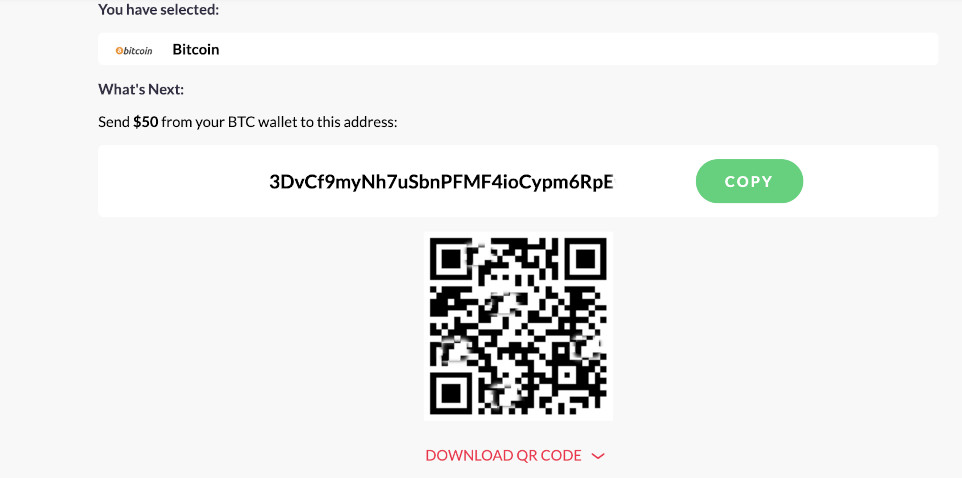

Crypto technology has also improved the ways in which players deposit and withdraw from a casino. By using a mobile crypto wallet, players can seamlessly deposit their funds straight to their casino account, without delay, and without extra costs incurred by third-party payment providers.

Crypto wallets also offer a few unique features that can be integrated into payment methods using the blockchain. In Deccentraland, for example, you can connect your crypto wallet to your player profile by scanning a QR code via your crypto wallet, allowing you to easily pay for goods and services without lengthy deposit and withdrawal processes.

Punt Casino also offers a similar approach – no more credit card details and deposit forms here, buddy. You can simply scan a QR code via your crypto wallet to make a deposit, and insert your wallet receiving address when making withdrawals with very little identification and none of your personal banking details required.

Of course, user-friendliness is very important to players, and technology such as this is really changing the game and continues to improve. With seamless payments and improved security (not to mention it’s cheaper), crypto payment methods are going to play a big part in the future of online gambling, which means the future of bitcoin casinos looks promising.

Provably Fair Games

What if we told you that players can now prove the fairness of the outcome in casino games using blockchain technology? The days of hoping that you are playing with a fair online casino are over because now, you can prove it.

“Provably fair” refers to an algorithm based on technology that offers a higher level of fairness and transparency in online casino games. The algorithm uses blockchain tech to produce random outcomes when the game is played, for example, shuffling the decks of cards in a blackjack game or generating random reel-stops in a slot to produce an outcome.

The provably fair algorithm generates an encrypted key, which looks similar to a crypto deposit or receiving address with the results of the outcome. The player can access this key along with a secondary key that allows them to verify the fairness of the outcome at the end of each round.

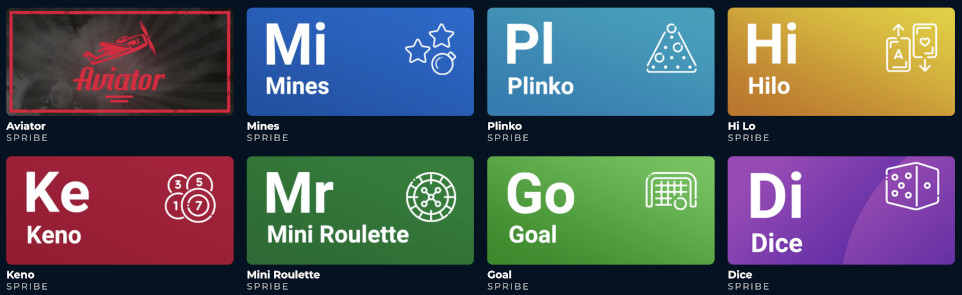

Games on our menu from the provider Spribe, for example, are all provably fair games and will allow you to verify the outcomes of each round when playing.

Provably fair casino games will most probably have a big impact on the future of bitcoin casinos and that of the online gambling industry as a whole, especially with this technology improving and with casinos finding new ways to use it.

Bitcoin Casinos: The Future of Online Gambling

Bitcoin price prediction plays a crucial role in shaping the future of online casinos. As the world increasingly embraces cryptocurrency, Bitcoin’s value is expected to soar, opening up new possibilities for the online gambling industry. With the decentralized nature of Bitcoin and its potential for secure and anonymous transactions, online casinos can provide players like you with enhanced privacy and convenience. Moreover, as Bitcoin’s price rises, the value of winnings and payouts at casinos such as Punt increases.

With all the technological advancements in the crypto space, the bitcoin casino future looks more than promising. Bitcoin and other cryptos will most likely shape the future of online gambling with massive breakthroughs in user-friendliness, payment methods, security, and even the games themselves and how we play them.

What the future of bitcoin casinos holds exactly, we can not say. But if you want to start experiencing the many benefits of crypto gambling, the Punt Casino is the place to do it.

With over 1,00 crypto-friendly casino games, massive crypto bonuses and promotions, and a state-of-the-art crypto casino platform, you can take a peek at the future of bitcoin casinos, right here.

Bitcoin Casino FAQs

What are Bitcoin casinos?

Bitcoin casinos are online gambling platforms that use the cryptocurrency, Bitcoin, for transactions. They offer the same types of games as traditional online casinos but with the added benefit of using a decentralized currency.

Are Bitcoin casinos legal?

The legality of Bitcoin casinos varies by jurisdiction. Some countries have fully embraced the concept while others have placed restrictions or banned it entirely. It is important to research the laws in your specific country before engaging in any form of online gambling.

Are Bitcoin casinos safe and secure?

Bitcoin casinos can be safe and secure if they follow proper security protocols and have a good reputation in the industry. However, it is important to do your own research and only play at reputable and trustworthy casinos.

Can you win real money at a Bitcoin casino?

Yes, you can win real money at a Bitcoin casino. The games offered are similar to those at traditional online casinos and are designed to be fair and provide a random outcome.

How do you deposit and withdraw money at a Bitcoin casino?

To deposit money at a Bitcoin casino, you will need to have a Bitcoin wallet and sufficient funds in it. You can then send the funds to the casino’s Bitcoin address. To withdraw, you will follow a similar process in reverse, sending the funds from the casino to your personal Bitcoin wallet.

What types of games are offered at a Bitcoin casino?

Bitcoin casinos offer a wide variety of games, including slots, table games, and live dealer games. The specific selection of games offered can vary between casinos, so it is important to check before signing up.

What are the advantages of playing at a Bitcoin casino?

The advantages of playing at a Bitcoin casino include the use of a decentralized currency, faster and cheaper transactions, increased privacy, and access to a wider range of games.