Last week’s biggest crypto news with a special bonus deal inside.

Crypto Espresso – The Top Crypto News Weekly at Punt Casino!

March 20, 2023

Crypto Espresso – The Top Crypto News Weekly at Punt Casino!

March 20, 2023

Top Crypto News Stories Last Week – Get the Full Scoop Now!

Last week’s top crypto news stories saw the U.S. judge in the Voyager Digital bankruptcy case publicly side with the crypto space over the lack of effective regulations.

Also, the Bitcoin mixing service, ChipMixer (which was rumored to be a CIA honeypot), was shuttered and $46.5 million in bitcoin seized, while the closure of Signature Bank led to a claim of anti-crypto bias from a well-known board member.

Continue reading for the full scoop on the biggest news for crypto last week.

Crypto News Headline: Voyager Bankruptcy Judge Calls for Proper Crypto Regulation

Despite all the talk surrounding the need for regulation in the crypto news space, the entities responsible in the U.S. don’t seem too inclined to actually create any, preferring to prosecute transgressors after the fact rather than informing crypto companies upfront whether their products fall foul of securities laws.

But now, support for crypto companies has come from an unlikely source – the judge in the Voyager Digital bankruptcy case, citing the lack of regulatory efforts made by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) through his comments in a filing regarding a reorganization and distribution plan for Voyager.

Judge makes his case

Wiles prefaced his comments by saying that the antipathy towards yet lack of action regarding cryptocurrencies offered an “unusual backdrop to this bankruptcy case”, with his opening remarks on the matter bringing the point home succinctly in the latest crypto news:

“There are firms that operate as cryptocurrency brokers or exchanges, and have done so for several years, without being subject to clear and well-defined regulatory requirements. Regulators themselves cannot seem to agree as to whether cryptocurrencies are commodities that may be subject to regulation by the CFTC, or whether they are securities that are subject to securities laws, or neither, or even on what criteria should be applied in making the decision.”

This sentiment echoes that of cryptocurrency organizations, many of which have expressed that they want to work within the law but simply don’t know how to do so. Judge Wiles noted that this uncertainty has persisted “despite the fact that cryptocurrency exchanges have been around for a number of years”, and then laid out the source of the frustration for many:

“There have been differing proposals in Congress to adopt different types of regulatory regimes for cryptocurrency trading. Meanwhile, the SEC has filed some actions against particular firms with regard to particular cryptocurrencies, and those actions suggest that a wider regulatory assault may be forthcoming.”

“The CFTC seems to have taken some positions that are at odds with the SEC’s views. Just how this will all sort itself out, how the pending actions relating to cryptocurrencies will be decided, and just what issues might be raised in future regulatory actions, and how they will affect individual firms or the industry as a whole, is unknown.”

What does it mean?

While these comments from the judge in this top crypto news article aren’t likely to spur the SEC or the CFTC into action, they highlight the fact that even someone who has come to the crypto space with little to no knowledge of it has swiftly realized that regulators simply aren’t holding up their end of the bargain.

Headline 2: ChipMixer Service Shut Down After CIA “Honeypot” Rumors

The Bitcoin mixing service, ChipMixer, has been shuttered, and $46.5 million in assets seized by an international law enforcement coalition. This comes months after a crypto news theory emerged that it had been taken over by the CIA and was being used as a ‘honeypot’.

American and German authorities, aided by Europol and agencies from other countries, shut down the service last week, taking almost 2,000 bitcoins and 7 TB of data after an investigation into potential money laundering through the site – four months after rumors emerged that a ChipMixer was established by the CIA to attract and catch criminals.

About ChipMixer

ChipMixer was established in 2017 and offered a unique take on the transaction masking process: funds were transformed into “chips,” which were mixed together to anonymize the origin of the initial funds.

This made ChipMixer a very attractive option for cyber criminals. Many used the service to launder illegal proceeds obtained from criminal activities such as drug and weapons trafficking, ransomware attacks, and payment card fraud. And a lot of these stories made top crypto news headlines across the world.

ChipMixer CIA “honeypot”?

When Twitter user “FatMan” (@fatmanterra) took a look into ChipMixer, he smelt a rat. In November 2022, he released a tweet thread laying out his reasons for ChipMixer being a CIA honeypot from the start. FatMan pointed to the fact that ChipMixer was established right at a time when the agency had “a number of different projects focused on cryptocurrency” going.

This became fairly big crypto news after FatMan also pointed out that high-profile hackers such as the Twitter hacker who laundered money through the site were swiftly arrested. He also revealed that ChipMixer had, until then, survived a Bitcoin mixing clampdown, possibly in an attempt to drive users to the service.

Whether or not the CIA was in on ChipMixer from the start, it will certainly be taking an interest now, with various U.S. authorities eagerly wading through the 7 TB of data recovered. The investigation into ChipMixer suggests that the platform may have facilitated the laundering of over 150,000 bitcoins in total.

Crypto News Headline 3: Signature Bank Closure Leads to “Anti-Crypto Bias” Claim

One of the latest crypto news talking points coming out of the closure of Signature Bank has been the role that crypto has played. Former U.S. representative and Signature Bank board member, Barney Frank, co-author of the 2010 Dodd-Frank regulations, claimed that the closure of the bank was an attempt by the U.S. government to send a “very strong anti-crypto message”.

While Signature Bank didn’t involve itself with crypto directly, it did safeguard U.S. dollar deposits of crypto companies and their customers. Frank believes that a potential bank run was the perfect excuse for the U.S. government to shut it down and paint crypto as the bad guy.

The New York Department of Financial Services, which conducted the closure, argued last week that the decision to shut down Signature Bank was “nothing to do with crypto”. It also said that the issue had been getting data from the bank and the evasiveness of directors regarding obtaining it. Frank, however, wasn’t buying this, telling the Intelligencer:

Now, the question is, why did they react so harshly to what they said was our inability to give them the sufficient data? I believe it was probably to send the message that even though we were doing crypto stuff responsibly, they don’t want banks doing crypto. They denied that in their statement, but I don’t fully believe that.

Other crypto news outlets and financial news platforms such as the Wall Street Journal have since come out and said that there is certainly evidence to back Frank’s theory. This will have other crypto-connected banks looking over their shoulders for sure.

Trending Crypto News Stories:

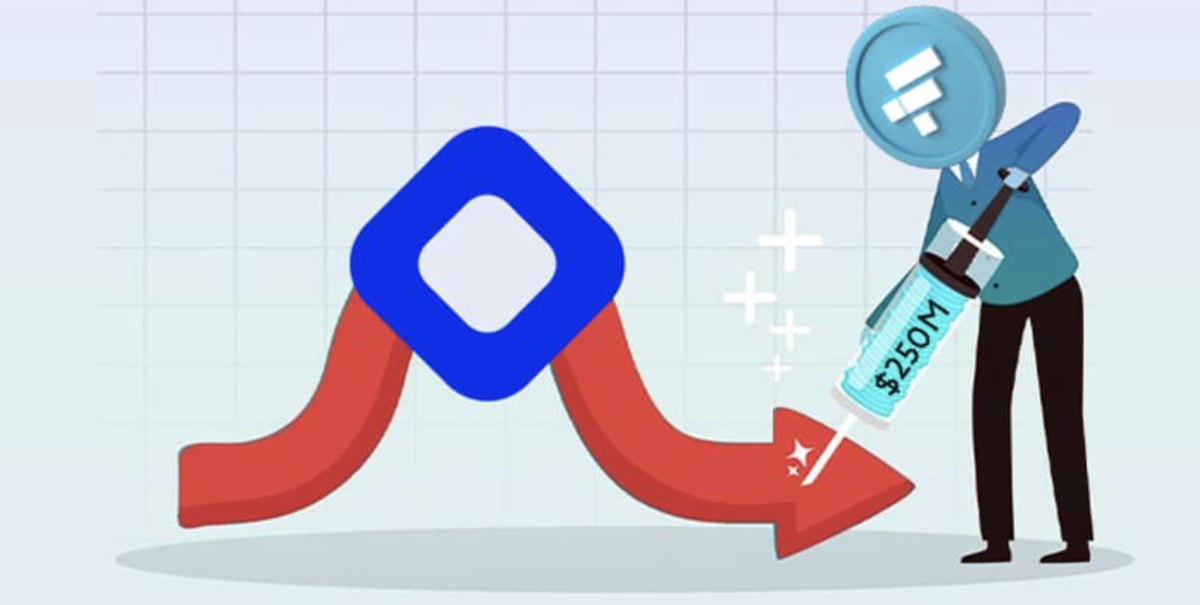

- The FBI is said to be investigating the collapse of the Terra USD/LUNA ecosystem last year, putting more pressure on its founder, Do Kwon.

- A security company has identified a series of vulnerabilities that it says threaten over 280 blockchains, with some already having been patched.

- A $1 billion class action lawsuit against multiple social media influencers who promoted FTX has been filed in Florida.

Enjoyed the biggest crypto news of last week? Don’t miss out on your weekly dose of the top stories in the crypto space at Punt. Sign up now and you’ll receive the Crypto Espresso weekly newsletter straight to your mail – including an EXCLUSIVE BONUS offer in the emails only!

Want to Know More About Crypto Gambling?

You can find more than just the latest crypto news at Punt – we specialize in crypto gambling offering the hottest casino games, bonuses & promotions, and tournaments on our platform.

Sign up today and you’ll qualify for Punt Casino’s massive welcome Package, offering a 150% BONUS + 15 FREE SPINS on one of our top casino slots, Gods vs Titans.

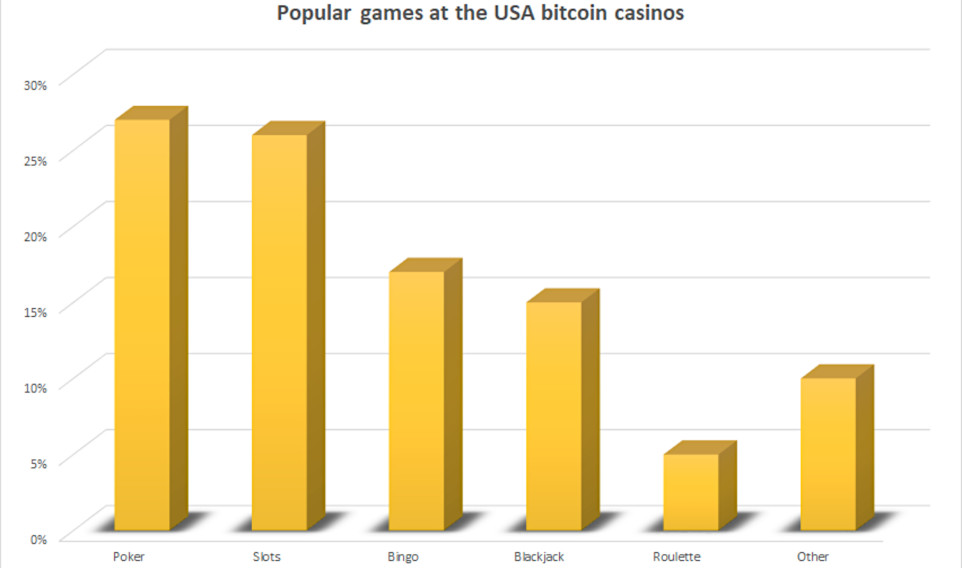

You can learn everything there is to know about playing at a bitcoin casino at Punt, including how to use the benefits of bitcoin gambling to your advantage and how to secure and protect your digital assets.

PLUS! You can take up daily casino bonuses and promotional offers to boost your bitcoin bankroll. Punt is certainly the place to be when it comes to claiming the best casino bonuses and free spins offers, so check them out today and don’t miss out.